|

Advancing women’s equality in the countries of Asia Pacific could add $4.5 trillion to their collective annual GDP in 2025, a 12 percent increase over the business-as-usual trajectory. Asia Pacific is today arguably the most dynamic region in the world, a global engine of growth driven by productivity, investment, technology, and innovation. Women can help—and are helping—to power this engine, making vital contributions to sustaining and enhancing Asia’s growth and lifting more people out of poverty. Yet gaps remain large in many countries in the region on gender equality both in work and in society. From an economic perspective, trying to grow without enabling the full potential of women is like fighting with one hand tied behind one’s back. Five potential areas to prioritize to improve gender parity in Asia Pacific There has been progress towards gender parity Asia Pacific overall. But there is still much more to do. Now is the time to redouble efforts. Advancing women’s equality in the countries of Asia Pacific could add $4.5 trillion to their collective GDP annually in 2025, a 12 percent increase over a business-as-usual GDP trajectory. This additional GDP would be equivalent to adding an economy the combined size of Germany and Austria each year.

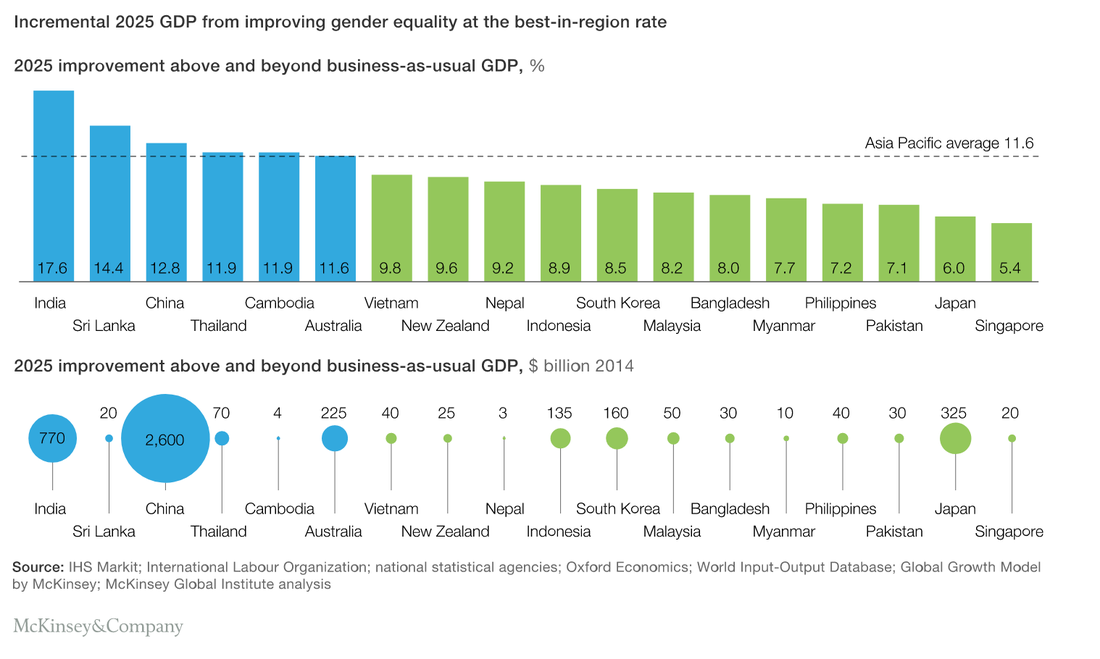

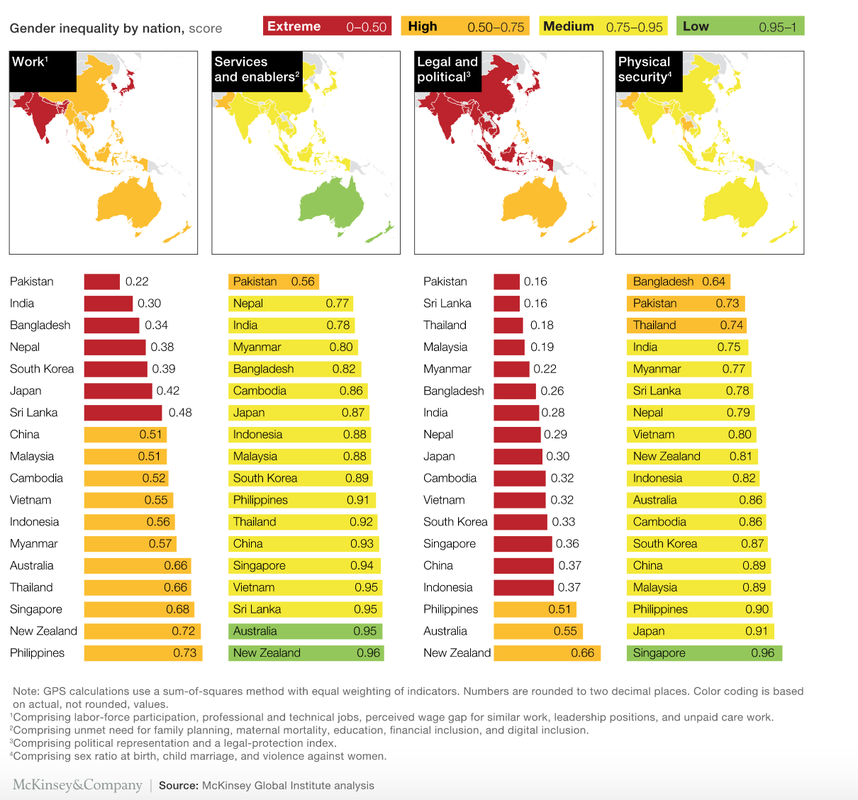

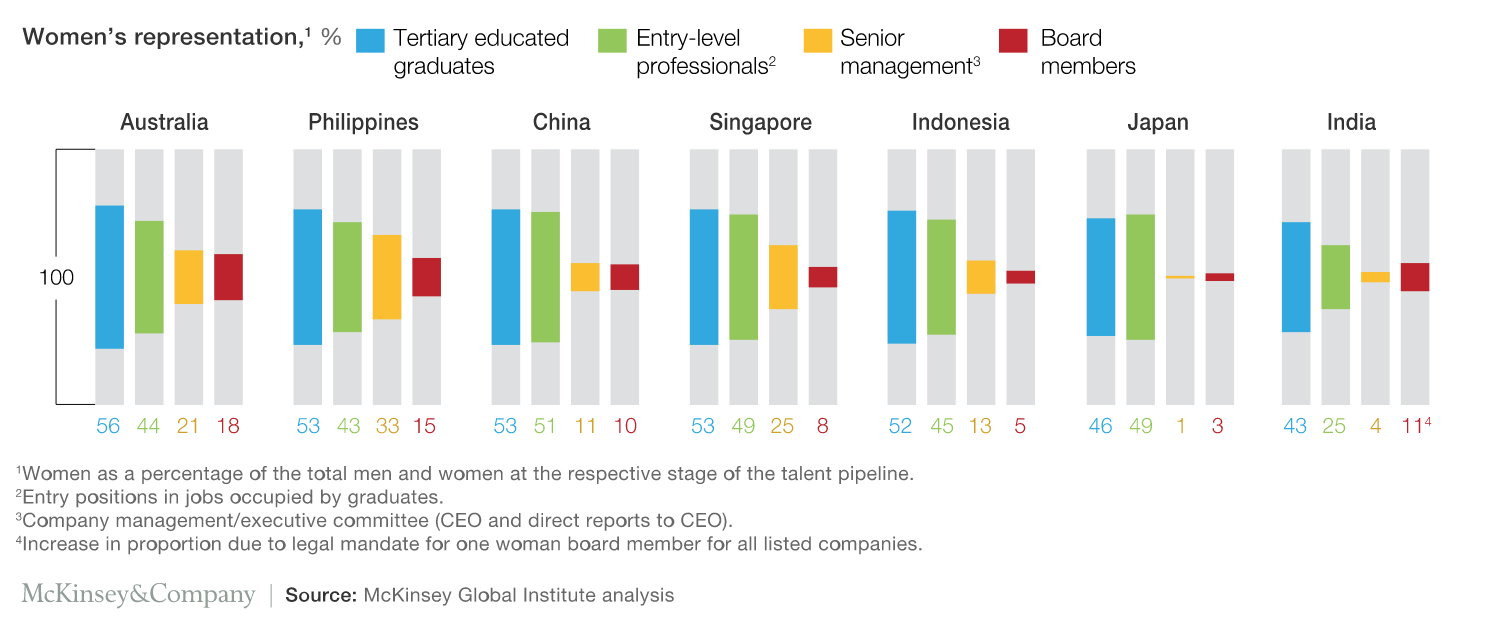

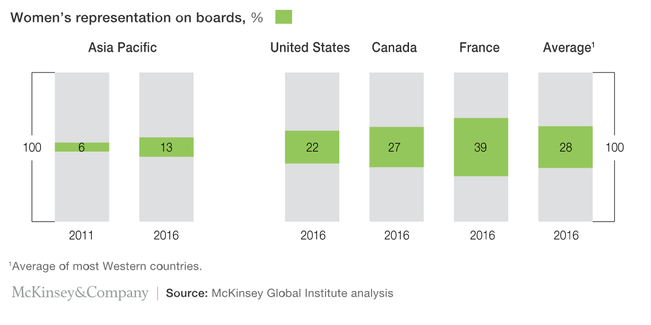

All countries in Asia Pacific could boost growth by advancing women’s equality All countries in Asia Pacific could boost growth by advancing women’s equalityAll countries Asia Pacific would benefit from advancing women’s equality. In a best-in-region scenario in which each country matches the rate of progress of the fastest-improving country in its region, the largest absolute GDP opportunity is in China, at $2.6 trillion, a 13 percent increase over business-as-usual GDP. The largest relative GDP opportunity is in India, which could achieve an 18 percent increase over business-as-usual GDP, or $770 billion (Exhibit 1). To achieve this significant boost to growth will require the region to tackle three economic levers: increase women’s labor-force participation rate, increase the number of paid hours women work (part-time versus full-time mix of jobs), and raise women’s productivity relative to men’s by adding more women to higher-productivity sectors. Of the total $4.5 trillion GDP opportunity, 58 percent would come from raising the female-to-male labor-force participation ratio, in line with the global average contribution. A further 17 percent of the GDP opportunity would come from increasing the number of paid hours women work, and the remaining 25 percent from more women working in higher-productivity sectors. McKinsey Global Institute’s calculation is a supply-side estimate of the size of the additional GDP available from closing the gender gap in employment. We acknowledge that the supply-side approach needs to be accompanied by demand-side policies that could influence the ability to create jobs to absorb additional female workers and require investment. In addition, education and vocational training systems will need to keep pace with rapid technological changes that are altering the nature of work and creating new types of jobs. There is no one Asia Pacific journey toward gender equality In its 2015 original “power of parity” report, MGI established a strong link between gender equality in work and in society—the former is not achievable without the latter. MGI’s Gender Parity Score (GPS) uses 15 indicators of gender equality in work and society to measure the distance each country has traveled toward parity, which is set at 1.00. Overall, Asia Pacific has a GPS of 0.56, slightly below the global average of 0.61—both high levels of gender inequality (Exhibit 2). The research examines Asia Pacific as a whole with a particular focus on seven countries: Australia, China, India, Indonesia, Japan, the Philippines, and Singapore. On gender equality in work, the Philippines stands out for its progress, followed by New Zealand and Singapore. The six countries furthest from gender parity in work are Bangladesh, India, Japan, Nepal, Pakistan, and South Korea. China does well on female labor-force participation but can improve its share of women in leadership—as can most countries in Asia. Gender inequality also remains high across the region in the sharing of unpaid care work. On gender equality in society, Australia, New Zealand, the Philippines, and Singapore are ahead of most in the region on essential services such as education, maternal and reproductive health, financial and digital inclusion, and legal protection and political voice; countries like Bangladesh, India, Nepal, and Pakistan still have a considerable distance to travel. Achieving gender parity in digital and financial inclusion is a large opportunity in many South Asian and Southeast Asian countries. Physical security and autonomy remains a concern in many parts of the region—and globally. Asia Pacific nations have made progress in the past decade, driven by a combination of economic development, government measures, technological change, market forces, and activism. Maternal mortality and gender gaps in education have declined in countries including Bangladesh, Cambodia, India, and Nepal. Many countries have increased women’s labor-force participation, but participation has fallen in Bangladesh, India, and Sri Lanka, a trend that may be linked to rising household income. Women are heavily underrepresented in leadership positions Women’s relatively low representation in leadership positions—measured using the female-to-male ratio—is a global issue. Worldwide, slightly less than four women hold leadership positions for every ten men in business and politics. In Asia Pacific, there is only one woman in leadership positions for every four men. In some countries in East Asia, there are only 12 to 20 women leaders for every 100 men. This is a waste of talent that the region can ill afford, especially when many economies are aging, labor pools are eroding, and skills shortages are on the rise (Exhibit 3). Most countries in Asia Pacific have female-to-male ratios of less than 0.5. Even in Australia, New Zealand, and Singapore, three of the region’s more advanced economies, the gender imbalance is notable. The Philippines, a traditionally matriarchal society whose government has been proactive in narrowing gender gaps, is the country in the world nearest to gender parity. However, even there, only 15 percent of board members are women. There has been progress in recent years. On average in the region, women’s representation on boards increased from 6 percent in 2011 to 13 percent in 2016 (Exhibit 4). This appears partly to reflect regulations and corporate policies instituted during this period. For instance, India has made it mandatory for companies to have at least one female director, and the Australian Securities Exchange Corporate Governance Council tracks gender diversity in its constituent companies. However, women’s representation on boards in Asia Pacific is still low compared with the average share in advanced economies of 28 percent. The smaller share of women in company leadership isn’t all about the glass ceiling. The relative lack of women in the top positions in business has its roots far earlier in the talent pipeline that runs from enrollment in tertiary education to entry-level positions, middle management, and the boardroom. In the seven countries we highlight in this research, the share of women erodes the further they are along this pipeline, with different patterns and bottlenecks among countries.

A McKinsey survey found that by far the largest barrier to women moving into senior roles cited by executives—45 percent—was the “anytime, anywhere” performance model. The second biggest—cited by 32 percent of respondents—was the “double burden” of women holding down a job while looking after their families, particularly in societies where women are still expected to take sole responsibility for family and household duties. Third was an absence of female role models, followed by a lack of pro-family public policies and support, including childcare; 30 percent of respondents cited the latter factor. Policy makers, companies, and nongovernmental organizations can consider prioritizing measures in five key areas Mapping the road ahead, policy makers, companies, and nongovernmental organizations could consider prioritizing action in five areas. Each of them applies across the region to differing degrees. Some aspects, namely female labor-market participation, are crucial for securing the potential economic benefits identified in most countries. Others, including the role that digital technologies can play, offer an opportunity to raise economic participation and earning while potentially improving gender equality in society. The imperative to shift societal attitudes toward women’s role in society and work appears in virtually all countries and can enable—or hold back—progress on all other aspects of gender inequality. Some approaches are more suitable for the formal economy, others for the informal economy. Broadly, measures need to be tailored to the cultural and economic context of each country, based on decision makers’ judgment—and experience—of what will be most effective. In the research, MGI has explored specific priorities for each of the seven countries highlighted. The following five key areas for action have relevance to all countries in the region:

2 Comments

Time magazine unveiled its annual list of the 100 most influential people in the world Thursday, including record numbers of 45 women and 45 people under the age of 40.

"The TIME 100, always a reflection of its moment, looks quite different than in the past," Time Editor-in-Chief Edward Felsenthal wrote in a letter explaining how the magazine chose the 100 people on the list. "Influence increasingly knows no single zip code and no minimum age." The magazine paired guest contributors to write about each of the 100 people on the list. Former president Barack Obama says he draws inspiration from the Parkland, Fla., shooting survivors turned activists who organized the March for Our Lives rally against gun violence. “They have the power so often inherent in youth: to see the world anew; to reject the old constraints, outdated conventions and cowardice too often dressed up as wisdom,” Obama wrote about Jaclyn Corin, Emma Gonzalez, David Hogg, Cameron Kasky, and Alex Wind. "The power to insist that America can be better." Among the 45 women chosen were activist Tarana Burke, who founded Me Too and human rights activist Nice Nailantei Leng’ete, who has worked to end female genital mutilation in Kenya. "While we remain much too far from gender parity in global leadership, there are more women than ever on this year’s TIME 100—proof that there are ways of changing the world beyond traditional power structures," Felsenthal wrote. Six of the top 100 will be featured on covers of the magazine’s special issue, and include: Burke; tennis champion Roger Federer; comedian and actor Tiffany Haddish; actor Nicole Kidman; singer Jennifer Lopez; and Microsoft CEO Satya Nadella. The list is not a measure of power or a collection of milestones but is instead, according to Felsenthal, "a designation of individuals whose time, in our estimation, is now." Or, in other words: “Was this their year?” WASHINGTON — Tuesday is “Equal Pay Day.”

It’s not a day of celebration, but more like a finish line for women. In 2018 women had to work, on average, until April 10 in order to earn as much money as men did by the last day of 2017. Each year, women hope that the distance to our finish line will be shorter and that the gap between what men and women are paid will close a bit more. Equal Pay Day reminds us of how far we’ve come, how far we have to go and the actions still needed to increase the earning power of our nation’s working women. When looking at median annual salaries for each group, U.S. women are paid about 80 cents for every dollar paid to men. And the pay gap is even worse for women of color. For significant change to occur, we believe more women need to assume leadership roles, especially by serving on corporate boards. There’s proof that having more women in board positions yields benefits for an organization’s performance, and for society as a whole. Statistics show there is plenty of potential for women to step into more board seats:

Boards of directors make decisions that can impact you, your community and the country. These boards choose CEOs who then make decisions about compensation and other ways to spend profits, including how to support various social causes. That’s why we think there should be more female voices representing our viewpoints and interests. In addition to societal advantages, research has shown that organizations themselves benefit from increasing diversity on their boards. First, gender diversity in a company’s leadership tends to attract and motivate talented employees who want leadership that reflects the diversity of today’s talent pool. Women are increasingly influencing spending decisions for their family’s wealth, so having women on a board provides more insight into the opinions and priorities of all consumers, not just males. Rodney McMullen, chairman and CEO of Kroger, suggested to his board that having a more diverse group of leaders “helps you avoid blind spots” when making important corporate decisions. For suggestions on how to improve your long-term financial security in the face of a pay gap, listen to Dawn’s WTOP 2017 Equal Pay Day interview. What are strategies women can use to achieve a corporate board seat? One of the reasons given for lower female representation in the boardroom is lack of sufficiently educated and qualified female talent. But statistics show women continue to earn advanced degrees at equal or higher rates than men. The real issue is not education, but lack of relevant experience. How then can women obtain the right qualifications to land a board position?

Our hope is that advocating for more representation for women on corporate boards will lead to stronger financial performance and higher pay for all employees, including women. Encouraging public companies to have a board that reflects the same diversity as their buying population is just one way everyone can make progress towards greater pay equality for all. Dawn Doebler, CPA, CFP®, CDFA® is a senior wealth adviser at The Colony Group. She is also a co-founder of Her Wealth®. Boardroom Gap: Companies with More Women in Leadership Perform Better (February 2018, Grank Welker)4/16/2018 Jennifer Conrad didn't have high expectations when she interviewed for a management position at the Leominster headquarters for Fidelity Bank. After all, she was seven-and-a-half-months pregnant.

"I felt like it was such a wasted effort," Conrad said. But "when I stepped out of the bank that day, I said, 'I need to be here.'" She was hired. And a decade later, Conrad, Fidelity Bank's senior vice president and senior cash management officer, serves as an example of a company's culture prioritizing having women in executive positions in equal numbers as men. "She was a very talented person and culturally aligned with how we treat our clients," said Ed Manzi, the Fidelity Bank CEO who hired Conrad and still leads the 10-branch bank. "It just seemed like the right thing to do." With nine women among its top 16 executives, Fidelity Bank is an outlier in the Central Massachusetts business community, as only four of the 42 local for-profit companies examined by WBJ had at least 40 percent women among their senior executives and board members. Fidelity Bank has seen its total deposits more than double in a decade to $659 million in 2016, and in the past year has grown through acquisitions of Barre Savings Bank and Colonial Co-operative Bank in Gardner. This type of financial success is a common thread among businesses with greater gender diversity in their leadership. Companies with women in at least 15 percent of senior management positions have 18-percent more profits than companies where women comprise less than 10 percent of those seats, according to a 2016 study by Swiss multinational financial institution Credit Suisse. The best performance was shown in companies where women make up half of senior leadership positions. "You don't get a diverse lens of what's happening inside and outside your company" without diversity, said Susan Adams, a Bentley University professor who's conducted research for the women advocacy group The Boston Club. "Women live different lives than men," Adams said. "They can see things differently." Woman-led profitsCompanies with women in the top leadership position (i.e. CEOs) were shown in the Credit Suisse study to perform better than those led by men, with 19-percent better profits. Among the 75 Central Massachusetts business organizations – including nonprofits – studied by WBJ, only nine led led by a woman, and none of those were public companies. One of the most recent female publiccompany CEOs in Central Massachusetts was Carol Meyrowitz, who led TJX Cos. from 2007 to 2016. The Framingham- and Marlborough-based owner of retail chains Marshalls, T.J.Maxx and HomeGoods touts relatively high levels of women throughout the business. Globally, 77 percent of TJX's workforce is female, as are 51 percent of assistant vice presidents. In the past three years, women at TJX have earned 51 percent of promotions into senior vice president roles, 40 percent of promotions into vice president roles, and 58 percent of promotions into assistant vice president roles. "At the board level and throughout the TJX organization, women are an important part of our workforce and represent an increasing percentage of our leadership team," Meyrowitz said in a statement. TJX has been a force in retail at a time when many of its competitors have struggled against big box stores and online retailers like Amazon. From the budget year Meyrowitz's CEO term began through the latest budget year, the company's profit rose 161 percent to $2.3 billion, sales jumped 69 percent to $30.9 billion, and the store count rose by 51 percent to more than 3,800. Meyrowitz said achieving goals at the company "relies to a great degree on our ability to continuously develop our next generation of leaders." Female CEOs = gender diversityFemale-led companies have been found to have better gender diversity throughout their ranks, according to a 2017 report by Chicago-based executive leadership consulting firm Spencer Stuart. At female-led American businesses, 33 percent of directors are female. At male-led firms, that rate is 22 percent. In Central Massachusetts, out of the 75 institutions examined by WBJ, the nine led by women have better records of appointing women to boards and executive offices. Their rate for boards is 43 percent, compared to 33 percent among all the organizations examined. Among executives, the rate is 57 percent at female-led entities compared to 36 percent among all. Female business leaders also help companies in intangible ways. Los Angeles-based executive recruiting firm Korn Ferry found last year in talking to 57 women CEOs at large national companies, female CEOs are more likely than male CEOs to be motivated by a sense of purpose and a belief their company could have a positive effect on the community and its employees. New York City-based investment research firm MSCI in a 2015 study found fewer instances of governance-related controversies such as cases of fraud and shareholder battles at companies with better gender diversity. Manzi, Fidelity Bank's CEO since 1997, said gender equality has never explicitly been the bank's objective. "We didn't target a number," he said, adding of the qualified candidates the bank has chosen, "it just so happens that a lot of them are women." On one wall in a Fidelity Bank meeting room is a message illustrating the bank's priorities with employees: "If you value the differences in people, the differences will provide value." Female-inclusive firms remain the exceptionOf Central Massachusetts's 17 public companies, women make up only 8 percent of executive positions. Twelve of the 17 companies don't have a female senior executive, and half of those don't have a female board member. "Biases and misconceptions continue to linger," said Danna Greenberg, a professor of organizational behavior at Babson College in Wellesley. Female candidates generally need to push for themselves for consideration more than a man does, Greenberg said, and a woman who might be seen as pushy could cause a different reaction than a man would. "Women need to figure out much earlier in their career how they balance that pushback from being a strong self-advocate," Greenberg said. Women held fewer high-level positions decades ago because they were less likely to have college degrees, but that's changed. Women make up a higher percentage of college graduates than ever, outnumbering men for the first time in 2014, according to the U.S. Census Bureau. "They're very highly educated, which has changed," Adams said of female candidates for high-level jobs. "You couldn't say that 20 years ago. You probably couldn't even say that 15 years ago." At Fidelity Bank, Conrad said she's seen an environment not typical in finance. "In my 20 years in banking, I hate to use this term, but it can be seen as a boys' club," she said. "It's so refreshing to go to chamber events with more women representing companies. I'd like to see more. Who wouldn't?" CORRECTION: This story has been changed to reflect that it was Fidelity Bank's deposits, not assets, that rose to $659 million. I have spent many hours talking with colleagues in international development about how to tear down the barriers that block women’s progress around the world. Now, we’re confronting the fact that every sector, including our own, has a serious problem with sexual harassment and violence. The norms that allow these abuses are the same ones that disempower the poorest women, and only when they are dismantled across the globe will all women and girls be able to lead the lives they want.

Practically speaking, though, what can a philanthropic organization like ours do to promote a goal—equality everywhere—that’s impossibly large? We’ve been investing in women’s health for a long time and seen significant progress. But as I spend more time visiting communities and meeting people around the world, I am convinced that we’ll never reach our goals if we don’t also address the systematic way that women and girls are undervalued. With a new focus on women’s economic empowerment, connecting women to markets, making sure they have access to financial services, and empowering them to help themselves, we aim to help tear down the barriers that keep half the world from leading a full life. We’ll spend $170 million over the next four years to help women exercise their economic power, which the evidence suggests is among the most promising entry points for gender equality. Simply put when money flows into the hands of women who have the authority to use it, everything changes. First, their families benefit. One in three married women in the poorest countries have no say over major household purchases. Research shows, however, that women are much more likely than men to buy things that set their families on a pathway out of poverty, like nutritious food, health care, and education. In Niger, for example, when women had more financial autonomy, their families ate more meat and fish. One of the most astonishing statistics I’ve seen is that when a mother has control over her family’s money, her children are 20% more likely to survive. Second, everyone starts to re-think the part women can play in their own communities. A recent study in India found that merely owning and using a bank account led women to work outside the home more. As a result, they earned more money, but they also changed men’s perception of them. By defying a social norm that confined them inside, they started to change it. Women acting on their own can do what all the philanthropic organizations in the world can never accomplish: change the unwritten rule that women are lesser than men. Our role, as we see it, is to make targeted investments that give women the opportunity to write new rules. First, our new gender equality strategy will seek to link women to markets. Hundreds of millions of women help run small farms across Africa and Asia, raising crops and livestock, but in most cases, they do so without knowing what is a fair price for their products. We want to help them overcome this barrier and prosper from their labor. To do so, we’ll support women farmers as they organize in collectives that aggregate produce from small farms and sell it to buyers at a fair price and, where possible, use mobile phone applications that provide real-time price information. We also want more women to use digital bank accounts. Many governments send welfare or safety net payments to low-income families, but this money is usually controlled by men. We will work on systems in eight countries, including India, Pakistan and Tanzania, to deposit it into accounts controlled by women. Finally, we’ll support self-help groups where women and girls teach one another about everything from launching a small business to raising healthy children—and reimagine their standing in society. In India, the more than 75 million women who already belong to such groups have proven a force for real progress. We want younger girls to have the same opportunity. During adolescence, parents place more restrictions on their daughters, and girls’ range of movement shrinks—in South Africa, for example, by more than half. Self-help groups can widen their horizons. I gained a valuable perspective on self-help groups when I spent an afternoon in Jharkhand, India, with Neelam Bhengra. She joined a group to learn how to increase the yields on her farm. But gradually, she organized the members to advocate for themselves with local government. “If I’m alone, I can’t do anything,” she told me. But with the support of her group, she said, “I will keep fighting for women until I die.” Neelam is a force for generations to come. She told me all about her children, who were going to school and planning for a future Neelam herself never imagined. The data says that their children, Neelam’s grandchildren, will be even more healthy–and more prosperous. We want to help more Neelams find their voice, seize opportunities, and change their world—and their children’s world—into what they dream it can be. It is the end of may, and thousands of student athletes are completing their final exams and graduating from university. If you are an employer, then whatever your recruiting period is you need to consider making a serious push to recruit and hire graduating student athletes.

While many of these athletes may have little work experience, what they do have is their passion and their work habits, which they have poured into building their athletic careers for the last 20 years. Now they are eager to figure out where to pour all their passion and apply their work ethic. 11 Reasons why you need to hire a past varsity athlete?

Setting goals, maintaining clear focus, working with a team and working under pressure, leading and motivating others, working hard consistently—these are some of the skills that athletes have been practicing for years, and now they are ready to transfer all of their passion, intensity, and hard work into your business. Don’t be fooled when you see lack of work experience on an athlete’s resume. The experience that she or he has had on the court or on the field has prepared them well for solid success in the working world. They may have played their last game, but it’s not all over for them. For them the game of life is just beginning. So harness the power of sport and find yourself an athlete to help take your business to a whole new level. Because Life is a Sport, and I know you both want to win. WOMEN RULE — Excited for POLITICO’s 5th annual “Women Rule” summit today in DC where I’ll be hosting a panel at 3:55 p.m. with S&P Chief U.S. economist Beth Ann Bovino, Rolls-Royce North America CEO Marion Blakey and SoulCycle CEO Melanie Whalen. We’ll be talking about how the U.S. economy could be in much better shape with more women in top executive positions and in the workforce more broadly. A couple of factoids per POLITICO’s Luiza Savage: There are 32 women CEOs of Fortune 500 companies — that’s a historic record but only 6.2 percent; There are fewer large companies run by women than there are by men named John. FIRST LOOK: A new report out Tuesday from Beth Ann and Jason Gold on women and U.S. GDP finds: “[A] dual-pronged effort of increasing entry and retention of more women to the American workforce, particularly those professions traditionally filled by men, represents a substantial opportunity for growth of the world’s principal economy, with the potential to add 5%-10% to nominal GDP in just a few decades. “If women entered, and stayed, in the workforce at a pace in line with, say, Norway, the U.S. economy would be $1.6 trillion larger than it is today, according to a scenario analysis conducted by S&P Global economists.” Event begins at 8:00 a.m. Featured speakers include: actress Kate Bosworth, “Me Too” movement founder Tarana Burke, Transportation Sec. Elaine Chao, Kellyanne Conway, Sen. Kirsten Gillibrand (D-N.Y.) and more. Livestream: here. FREEDOM CAUCUS NEARLY TOPPLES TAX VOTE — POLITICO’s Bernie Becker, Sarah Ferris, and Colin Wilhelm: “House conservatives threatened to derail a key tax vote on Monday in an attempt to win more influence over the GOP's spending strategy, just four days before the deadline to fund the government. In a dramatic political stunt, more than a dozen members of the House Freedom Caucus withheld their support for a crucial procedural vote on the GOP’s tax bill, threatening an embarrassing blow to GOP leadership. “The conservatives eventually relented, approving what had been thought to be a formality — a motion to appoint negotiators to hammer out a final tax bill with the Senate. But the frenzy on the House floor underscored the divisions within the GOP over a spending strategy this month, and that the Republicans’ march toward overhauling the tax code — which has proceeded with relatively little drama so far — could get caught up in the process.” HOUSE CONFERENCE MEMBERS — After the Freedom Caucus stood down on Monday, Ryan ended up naming nine members to the conference committee, headlined by Ways and Means Chairman Kevin Brady (R-Texas). Reps. Devin Nunes (R-Calif.), Peter Roskam (R-Ill.), Diane Black (R-Tenn.), Kristi Noem (R-S.D.), Rob Bishop (R-Utah), Don Young (R-Alaska), Greg Walden (R-Ore.) and John Shimkus (R-Ill.) were also named as conferees.” Read more. FIRST LOOK II: TRUMP MENTIONED LESS ON EARNINGS CALLS — Per report out this a.m. from Hamilton Place Strategies on Q4' 16 to Q3 '17 earnings call transcripts: “The number of earnings calls mentioning President Trump declined 81 percent between January and late November … The count of calls mentioning tax reform have increased 137 percent since last quarter. … “Mentions of company culture — inclusive of corporate social responsibility, diversity, and harassment — have increased 32 percent year-over-year in 2017 … Amazon was mentioned on almost eight percent of all earnings calls so far in 2017, outstripping Google in second place with four percent” NEW FROM TPC — The Urban Institute/Brookings Tax Policy Center in its latest analysis of the Senate bill: “We find the bill would reduce taxes on average for all income groups in both 2019 and 2025. In general, higher income households receive larger average tax cuts as a percentage of after-tax income, with the largest cuts as a share of income going to taxpayers in the 95th to 99th percentiles of the income distribution. “On average in 2027, taxes would change little for lower- and middle-income groups and decrease for higher-income groups. Compared to current law, 7 percent of taxpayers would pay more tax in 2019, 10 percent in 2025, and 48 percent in 2027.” Read more. BONKERS QUOTE OF THE DAY — This time goes to House Minority Leader Nancy Pelosi on the tax bill: “It is the end of the world. … This is Armageddon.” SAY WHAT YOU want about the merits of this tax bill. It’s got issues on debt impact, middle class tax hikes and the big bet on corporate rate cuts. But the end of the world it is not. Saying it is just makes one sound ridiculous. GOOD TUESDAY MORNING — Greetings from DC! Hope to see some of you at “Women Rule.” Email me on [email protected] and follow me on Twitter @morningmoneyben. Email Aubree Eliza Weaver on [email protected] and follow her on Twitter @AubreeEWeaver.

THIS MORNING ON POLITICO PRO FINANCIAL SERVICES -- Victoria Guida on Acting CFPB Director Mick Mulvaney’s comments that he has no plans to fire Leandra English, the agency’s deputy director who is suing him. To get Morning Money every day before 6 a.m., please contact Pro Services at (703) 341-4600 or[email protected]. DRIVING THE DAY — President Trump lunches with members of the Senate GOP at the White House … At 1:45 p.m., Trump “leads a discussion with American business owners and their families” … Senate Banking at 10:00 a.m. marks up the "Economic Growth, Regulatory Relief and Consumer Protection Act" and votes on the nomination of Jerome Powell to be Fed chair … ISM Non-manufacturing at 10:00 a.m. expected to dip to 59.0 from 60.1 … HEARING PREP — Compass Point’s Isaac Boltansky on the Senate Banking reg relief bill: “We expect the following during the mark-up: (1) an intent focus on the mechanics of the bank stress test changes; (2) a handful of peripheral amendments … (3) a series of messaging amendments with no path to inclusion; and (4) questions relating to the $10B threshold vis-a-vis the QM safe harbor and bank regulatory offramp. “Securing floor time in the Senate is an unknown variable given ongoing tax reform efforts and uncertainty regarding Sen. Schumer's procedural preference, but we believe S.2155 could clear the Senate in January or February.” GET SMART FAST — BI’s Josh Barro with a good read on exactly how the tax bill will impact folks: “In the near term, the bill will give most Americans a tax cut. It's also likely to boost the economy at least a little bit over the next couple of years — though its positive economic effects will fade over time, and may even turn negative by the end of the decade, depending on which analysis you believe. … “The first sign of the tax changes should show up in workers' paychecks in January, when employers adjust tax withholding to reflect lower (or, in the case of an unfortunate few, higher) tax liability.” Read more. DAGGER AIMED AT NEW YORK — NYT’s Ben Casselman and Patrick McGeehan: “The tax bill approved by the Senate is many things, offering a huge tax cut for corporations, lower rates for the wealthy, and a big victory for Republicans and the White House. It is also an economic dagger aimed at high-tax, high-cost and generally Democratic-leaning areas — most notably New York City and its neighbors. “The bill, if enacted into law, could send home prices tumbling 10 percent or more in parts of the New York area, according to one economic analysis. It could increase the regional tax burden, complicating companies’ efforts to attract skilled workers. It could make it harder for state and local governments to pay for upgrades to the transit system and other infrastructure” Read more. COAL CEO SLAMS TAX BILL — CNBC’s Michelle Fox: “The Senate's tax overhaul bill is a ‘huge tax increase’ on certain businesses, said Robert Murray, chairman and CEO of coal giant Murray Energy. Murray, who has been a big supporter of … Trump, told CNBC he's specifically upset about the decisions to keep the alternative minimum tax and to take away the deduction for net interest expense as a cost of business. “He said the Senate legislation will raise Murray Energy's taxes by $60 million a year, ‘notwithstanding the other so-called benefits the Senate has proposed.’ ‘This means that very capital-intensive, highly leveraged employers, like coal-mining companies, will be forced out of business, with tragic consequences for our families and for many regions of our country,’ Murray said” Read more. PAID LEAVE INCENTIVE LIKELY TO STAY — Bloomberg Law’s Tyrone Richardson: “A measure that would offer tax incentives for companies to provide paid leave for employees is predicted to remain intact as House and Senate lawmakers start negotiating a compromise to the tax reform bill this week.” Read more. RYAN THOUGHT ABOUT DUMPING FRELINGHUYSEN — POLITICO’s Rachael Bade and John Bresnahan: “Speaker Paul Ryan and his leadership team discussed replacing House Appropriations Chairman Rodney Frelinghuysen after he bucked the party and voted against the GOP tax bill, multiple sources told POLITICO. Ryan, House Majority Leader Kevin McCarthy (R-Calif.) and Majority Whip Steve Scalise (R-La.) considered calling up the GOP steering committee charged with selecting chairmen to force a roll call on whether Frelinghuysen should maintain his position. “Scalise, three sources said, pushed hard for the move and was livid that the New Jersey Republican opposed the legislation that leaders believe is vital to maintaining their majority. … Spokespeople for Ryan's office and the Appropriations Committee declined to comment.” Read more. CBOE, CME POISED FOR BITCOIN BATTLE — FT’s Phillip Stafford: “Chicago’s two largest derivatives exchanges are going head to head in coming weeks to become the U.S. market of choice for bitcoin futures trading. “Cboe Global Markets said on Monday it would begin trading its bitcoin futures contracts, known as XBT futures, next week, on December 11, offering free trading for the rest of the month to help spur transactions. That will steal a march on its rival, CME Group, the world’s largest futures exchange, which will launch its futures contracts the following Monday. Read more. And hedge funds are getting ready — Bloomberg’s Rob Urban and Sonali Basak: “The planned introduction of bitcoin futures contracts at CME Group Inc., Cboe Global Markets Inc. and Nasdaq Inc. will make it much easier to bet on a decline. “Hedge funds, which have largely stayed on the sidelines, are waiting for the Chicago Mercantile Exchange’s futures market to open for a fresh opportunity to bet against the cryptocurrency, according to more than a half dozen people trading the assets. Read more. SEC TARGETS INITIAL COIN OFFERING ‘SCAM’ — WSJ’s Paul Vigna: “The U.S. Securities and Exchange Commission on Monday announced its first-ever enforcement action by its new cyber unit against an initial coin offering, alleging a Canadian company violated U.S. securities laws in raising $15 million through this new, red-hot area of finance. “Charges against the company, described by the agency as a ‘scam’ run by a ‘recidivist Canadian securities law violator,’ were brought by the unit as it looks to crack down on potential abuse in the cryptocurrency arena.” Read more. SEC TO PROBE IF BANKS HELPED HEDGE FUNDS INFLATE RETURNS— Bloomberg’s Matt Robinson: “Wall Street banks are known to fiercely compete for hedge-fund clients because of the lucrative trading profits they provide. The U.S. Securities and Exchange Commission is now investigating whether some banks crossed the line to win business by offering hedge funds bogus price quotes on hard-to-value bonds, said two people familiar with the matter. The SEC’s concern: As a reward for helping hedge funds make money — by submitting quotes at requested levels — banks got trades steered their way.” MORGAN STANLEY LAUNCHES ‘ROBO’ SERVICE — WSJ’s Lisa Beilfuss: “Morgan Stanley has launched an automated-advisory service, the latest wealth-management firm to expand digital offerings in a bid for younger investors’ assets. The New York brokerage firm said its Access Investing ‘robo’ service is available starting Dec. 4 to clients with at least $5,000 to invest. The service will charge 0.35 percent of assets annually. Fees exclude those levied by fund managers. … “Executives said Morgan Stanley’s robo launch is meant to attract a new generation of clients, many of them the children of existing customers positioned to inherit significant wealth. ‘Access Investing is an opportunity for financial advisers to grow their book of business by making connections early,’ said Naureen Hassan, the firm’s chief digital officer.” Read more. NEST EGGS HAVE NEVER BEEN BIGGER — Bloomberg’s Jordan Yadoo: “As U.S. stocks continue hitting new highs, President Donald Trump is encouraging Americans to check out their retirement accounts. ‘Look at your 401-k’s since Election,’ the president tweeted Monday morning. ‘Highest Stock Market EVER! Jobs are roaring back!’ Indeed, equity market gains have pushed average IRA and 401(k) balances to record levels. Unfortunately, there’s nothing to see for about half of American households that have no such retirement-savings vehicles. “Fidelity Investments, the nation’s largest administrator of retirement plans, said the average 401(k) balance in its accounts hit a record $99,900 in the third quarter while the average IRA rose to an all-time high of $103,500. Balances increased 10 percent from the same period a year ago, according to the Boston-based investment firm.”  1. The Mindful Giver Hali Lee, 51, founder of the Asian Women Giving Circle and co-founder and co-executive director of Faces of Giving, dedicated to amplifying the power of philanthropy. "In my mind's eye, I'm 28 years old, so the gift of now is that I have the energy and ideas of a younger person with the experience and insight of an older person. It's impossible to have everything, do everything, be everything. It is possible to do well enough, get by, try your hardest, be okay with the grays and the imperfects and to have a good enough time — dare I say fun — while doing so."  2. The Social Reformer Sujatha Jesudason, 51, Professor of Management at the New School and founder and Executive Director of CoreAlign, a reproductive justice organization. "At this age, I'm trying new things — what better time to risk it all? I just moved to New York City for the first time in my life. I'm the most impactful I've ever been in my work, and I'm also transitioning into the role of mentor. More of my energies are going into supporting other women, and in this political moment, that is powerful. We need to go all out."  3. The Breakthrough Researcher Dr. Carolyn Westhoff, 66, a leader in contraceptive research and family planning services at New York Presbyterian Hospital at Columbia University Medical Center. "When I turned 60 I thought, 'What would be worth accomplishing at work in the next 10 years?' and I chose to focus on enduring problems in the area of oral contraceptives, how to move those forward. In my 60s, I'm calmer and wiser, with a lot of history to draw on when issues arise — and I'm so grateful that the smart, idealistic young people I work with are not despairing even now. They're dynamite."  4. The Design Innovator Ruth Lande Shuman, 74, founder of Publicolor, a not-for-profit organization using design projects to empower struggling students to realize their potential. "Curiosity continues to imbue my work, which allows me to be flexible and responsive to new ideas. My age and experience mean that I can act as a mentor to young talent, which is enormously energizing! I am more patient, but I still have a sense of urgency around my work, and I want to keep growing Publicolor's impact, helping even more high-risk low-income students reach their potential."  5. The Founding Feminist Marie Wilson, 77, founder of the White House Project, the Ms. Foundation for Women, and creator of Take Our Daughters to Work Day."It's hard for me to slow down, even now. What keeps people strong and healthy is the ability to make change — in their job, in their community or in their home. What's kept me sane is the continual ability to do something about what's wrong in the world — through the civil rights movement, the women's movement, the gay rights movement, and all the things we are struggling with right now. I get up every morning and I know there's something I can and must do."  6. The Cultural Curator Nancy Spector, 58, Artistic Director and Jennifer and David Stockman Chief Curator at Solomon R. Guggenheim Museum."At this point in my life I am able to be decisive and direct in my leadership but also still open and attuned to what is new, radical, and risky in my field. I am deeply committed to doing what I love, honing my curatorial skills, and looking for opportunities to use art to address the profound concerns of our time."  7. The Intrepid Advocate Sayu Bhojwani, 50, founder and President ofNew American Leadersand author of People Like Us, about American democracy. "As an immigrant woman of color, I represent so much that is under attack in this country today. Yet I have never been more sure of who I am and what I believe is possible here. That I continue to lean into my work at the intersection of immigration and politics is a testament for women like me to never shy away from the battle for our place at the table."  8. The Eco Protector Deborah Goldberg, 63, Managing Attorney ofEarthjustice's, Northeast regional office. "I work as an environmental lawyer and we are trying very hard to protect a healthy planet for all species. Right now I'm working to get New York State law to require cleaning products to disclose their list of ingredients so people aren't bringing home things that will make their families sick. These are difficult times, and at this age, I have a long view — I know that we need to stay hopeful and keep fighting."  9. The Scholar Kimberlé Crenshaw, 58, renowned civil rights advocate and leading scholar of critical race theory at the UCLA School of Law and Columbia Law School. On intersectionality, a term she helped advance: "Without frames that allow us to see how social problems impact all the members of a targeted group, many will fall through the cracks of our [social justice] movements. When there's no name for a problem, you can't see a problem. When you can't see a problem, you can't solve it."  10. The Organizer Heather Booth, 72, organizer for justice and democracy. "It is a gift to be able to do the work building a better society where all people will be treated with dignity and respect. And at this age, I am grateful to have a little more confidence than I did earlier. We are in perilous and inspiring times. The stakes are so high, but often out of the greatest crisis comes the greatest progress. But only if we organize." |

Archives

April 2019

Categories

All

|

RSS Feed

RSS Feed